|

|

| |

April 2024 |

|

|

|

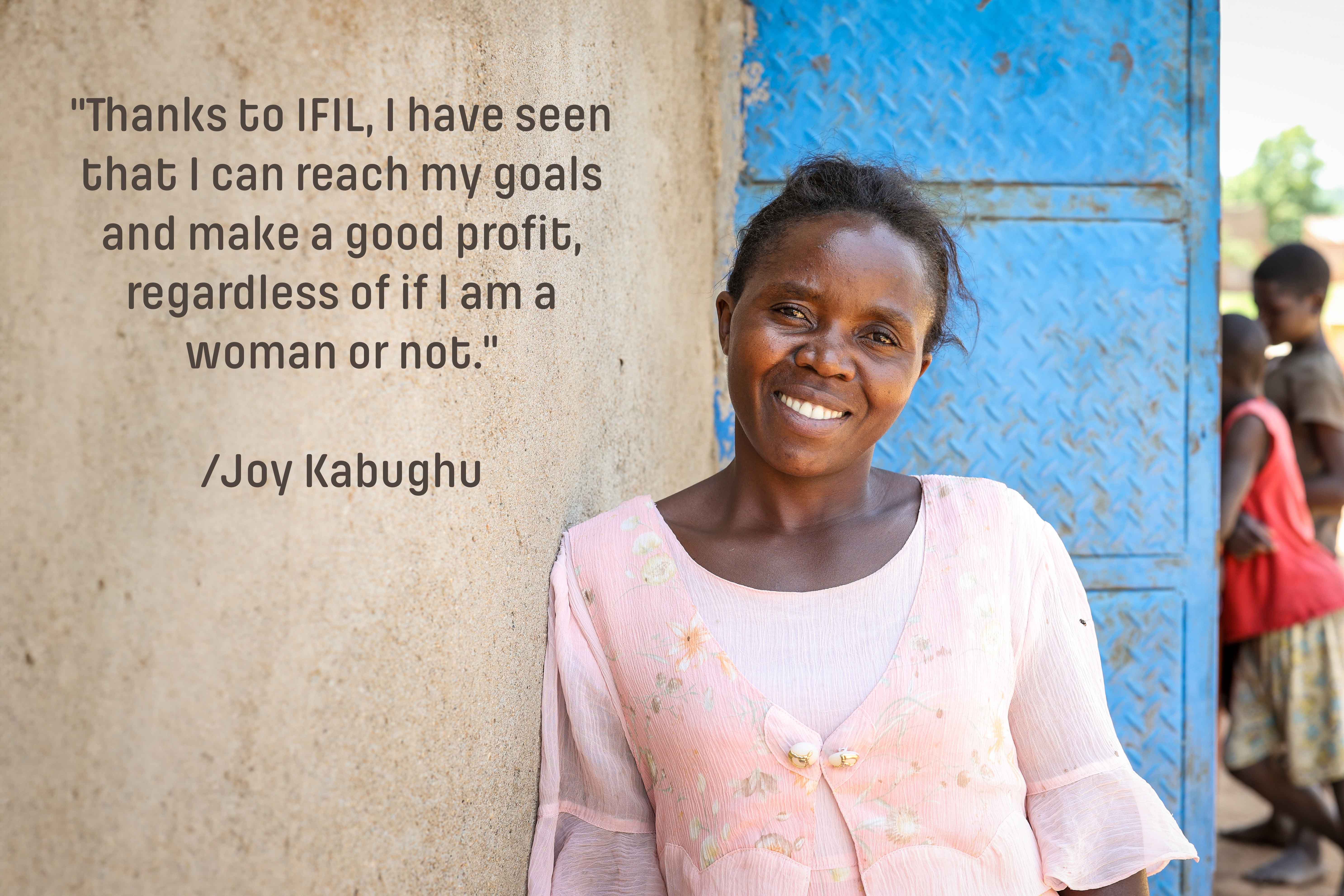

Biira, Jane, Annet, Joy and Janet are farmers and members of the Kihungu Kasebere Cooperative Society in western Uganda.

|

In this newsletter we are happy to share a quick project snapshot, based on the recent mid-term evaluation.

|

|

|

|

Though it may just seem like yesterday that the IFIL-project started, we are now already halfway through its duration (2022-2026).

So far, we have seen significant achievements, including the disbursement of an impressive $130,000 to seven Farmer Based Organizations (FBOs) across Uganda and Kenya through its small credit facilities. Additionally, commercial loans totaling $6.4 million have been extended to four FBOs. Alongside the financial support, extensive capacity training programs have also been implemented in both countries, aiming to strengthen 30 FBOs, through the collaborative efforts of We Effect, Act Church of Sweden, and Oikocredit who are running the project together. However, in spite of these substantial investments, what really matters is the impact on the ground. And that’s why we are especially excited to share some of the key findings with you from the mid-term evaluation. |

|

|

|

|

Erica Pellfolk, Program Manager, Act Church of Sweden. |

"The evaluation shows that thanks to IFIL, more farmers have gained access to loans faster, more women are involved in farmer cooperatives, and the collaboration between Act Church of Sweden, We Effect, and Oikocredit has been well-coordinated"

/Erica Pellfolk |

|

Erica Pellfolk, Act Church of Sweden’s project coordinator for IFIL, has read the report and is encouraged by the findings.

"The evaluation shows that thanks to IFIL, more farmers have gained access to loans faster, more women are involved in farmer cooperatives, and the collaboration between Act Church of Sweden, We Effect, and Oikocredit has been well-coordinated," she states.

And indeed, the evaluation unveils many concrete examples of progress. IFIL has directly facilitated access to finance for FBOs, leading to expanded investment opportunities and individual farmer benefits. In Uganda, women have emerged as key beneficiaries, with 60% accessing resources to bolster their coffee, maize, and bean farming endeavors. Additionally, there has also been a noticeable rise in female representation in FBO leadership roles during the course of the project, indicating strides towards gender equality and more inclusive decision-making.

Similarly, in Kenya, the IFIL project has been instrumental in improving FBOs' capacity to access and manage credit effectively. However, there are still challenges in regards to gender equality and a lack of sufficient female representation in leadership roles in the Kenyan FBOs to be further adressed. Including women at all levels of the value chain is crucial to improving livelihoods. Female informants clearly show a particular focus on the welfare of their entire families and community, and bring unique skills and perspectives that help combat poverty and violence, according to the evaluation.

Pellfolk also emphasizes the importance of initiatives like IFIL in promoting sustainable livelihoods.

"Efforts like IFIL, which provide access to investment capital at reasonable interest rates, truly contribute to increased livelihoods and the opportunity for cooperatives to professionally develop their operations. This is also completely in line with the government's reform agenda and something that we are excited to be a part of”, she affirms. |

|

|

| Joy Kabughu has participated in the trainings offered to the Kihungu Kasebere Cooperative Society in western Uganda. |

|

Moreover, the evaluation highlights the importance of the capacity building aspects of the project. Recommendations include further developing innovative Training of Trainers methods for wider reach and impact. However, in general the IFIL project's training initiatives have received widespread praise and catalyzed tangible improvements in FBO management practices, with policies now firmly in place to guide operations, thanks to the trainings.

"Without the specialized knowledge and capacity that IFIL contributes, these cooperatives would not have been able to access these loans previously," Pellfolk notes.

For several FBOs, the loans have also been of critical importance. One such FBO is NUCAFE, which we have previously written about in last year's December newsletter.

NUCAFE was approaching collapse in the wake of the pandemic, however when they were selected as one of the beneficiaries for the commercial loan, everything turned around. 237 primary cooperatives under NUCAFE have rejuvenated, serving over 2 million smallholder farmers and 337 000 household farming families, according to the evaluation.

“All in all, I am very happy to see that through this program, we have been able to contribute to more gender-equal farmer cooperatives and provide access to finance and investment avenues, particularly benefiting women”, Pellfolk concludes.

|

|

|

|

Access to affordable financial services for small farmer-based producer cooperatives and savings and credit cooperatives is a major constraint to achieving targets in rural development strategies and the Sustainable Development Goals (SDGs). This affects women more than men as collateral is usually required to access financial services, something that women often do not have. Estimates from FAO show that more than 70 percent of women-owned small and medium enterprises have inadequate or no access to financial services.

|

|

|

|

|